Fun Tips About How To Avoid Paying Self Employment Tax

Once you make over $600 in a year from a client, that client is required to send you a 1099 form.

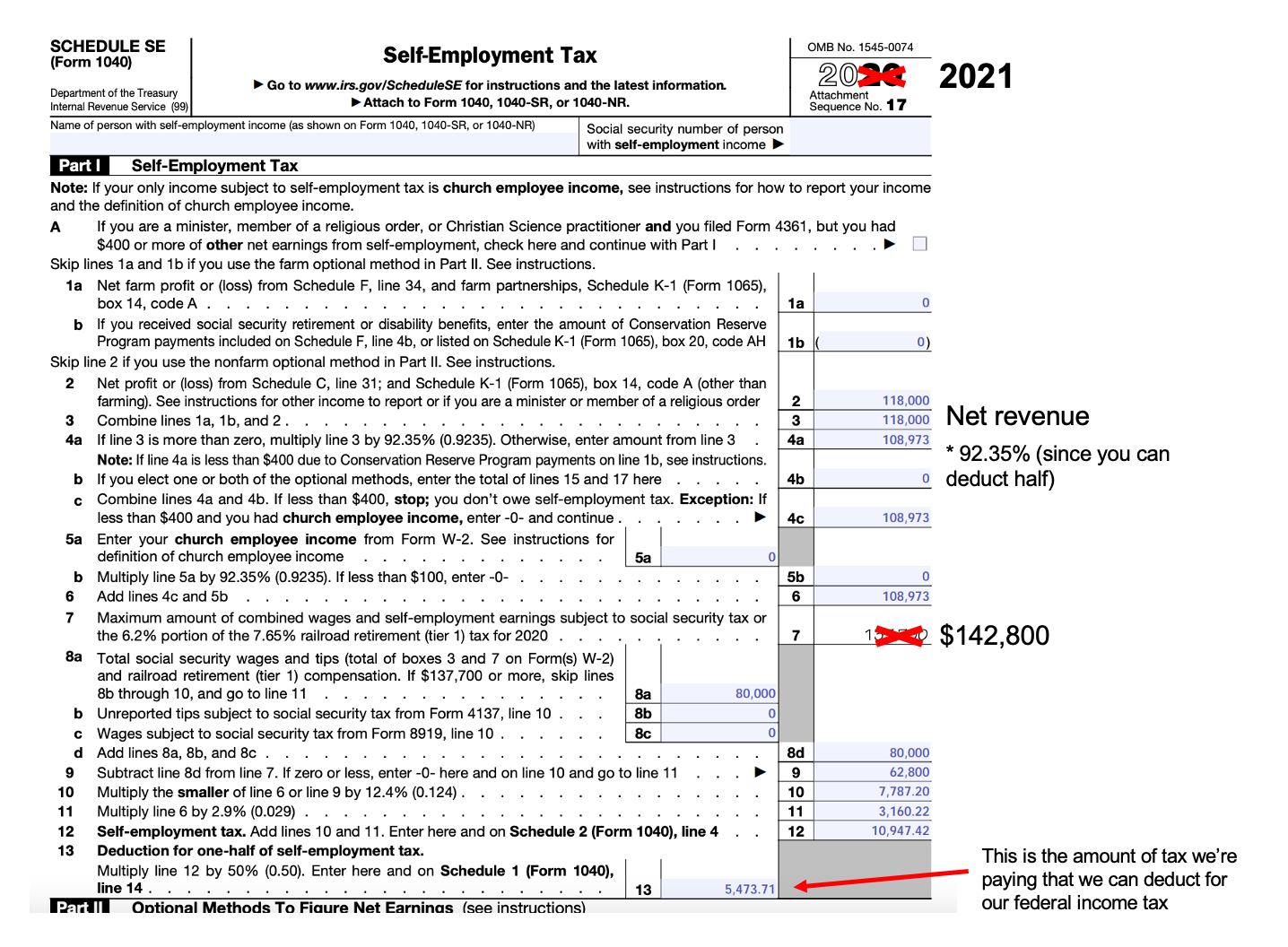

How to avoid paying self employment tax. We have the experience and knowledge to help you with whatever questions you have. One notable exception is if the 15th falls on a. Se tax is a social security and medicare tax primarily for individuals who work for themselves.

Put money in your retirement accounts. The most you can do is reduce your tax bill. Estimated taxes are paid quarterly, usually on the 15th day of april, june, september and january of the following year.

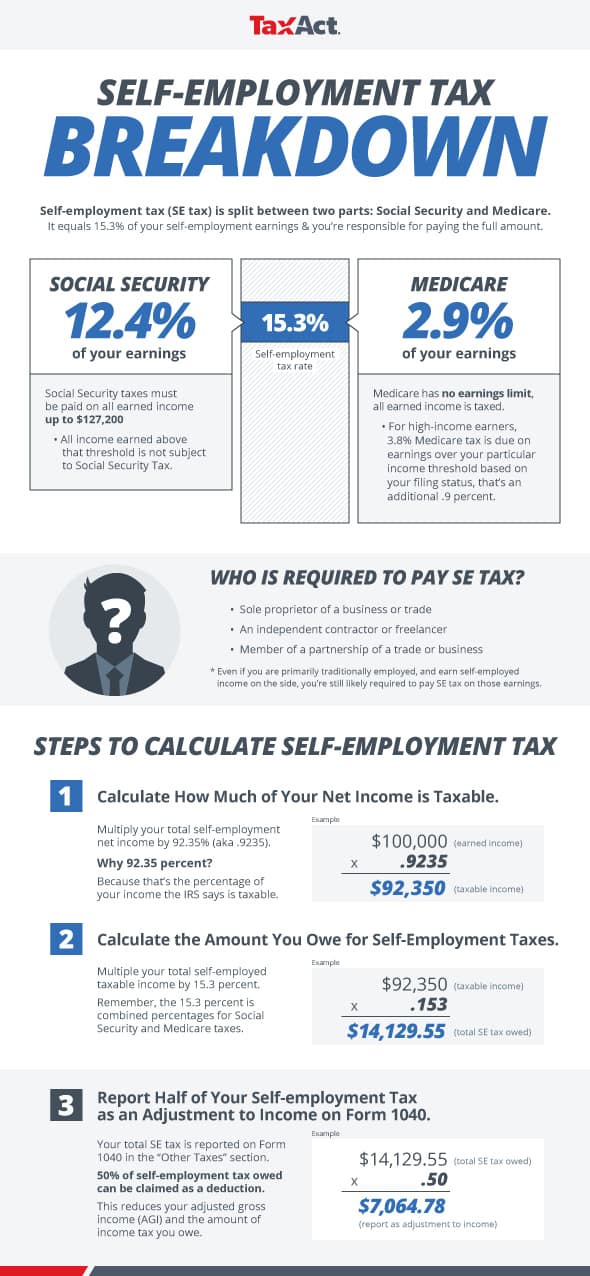

Tips to reduce self employment taxes. However, the irs allows this. Social security represents 12.4% of this tax and.

This will reduce your net. The way in which you can do this is by increasing your business expenses;. Get the tax answers you need.

If you form an llc, people can only sue you for its assets,. It is similar to the social security and medicare taxes withheld from the pay of most wage earners.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)